If you were searching for “Looking for someone to take over my mortgage” in order to get the solutions that will get you out of this browsing rut, you have arrived at the right piece of information. We’ll clear up any confusion you may have in this regard in this article. So, stick with us until the conclusion of this piece, and you will no longer be require to search for information on this subject.

Generally speaking, banks will not allow you to simply take possession of a mortgage title or transfer it to a third party in its entirety, so you’ll need to apply for a new home loan and pay off the prior loan before you can go on with your life.

You may be able to take over your parents’ mortgage with the help of a mortgage broker and a solicitor, but there are certain limits.

What is the process for assuming responsibility for your parents’ debt?

If your parents are having financial difficulties, there are a number of steps you may take to help them while still protecting both of your rights in the property.

Communication with your lender is crucial; you should get expert guidance from a mortgage broker, an experienced attorney, or any other legal counsel if you have any questions.

Is it feasible for me to just assume control of the mortgage title and go on?

In the absence of any real estate or other kind of security, a bank cannot simply give a home loan, and this is the rationale for that restriction.

In order to reduce the existing mortgage balance, the revenues from the sale of the property will be utilized to pay down your mother’s and father’s outstanding debt.

Due to the absence of any kind of due-on-sale clause in the mortgage, it would be necessary to charge the homeowner a fee for the privilege of absorbing his or her existing mortgage.

Have you given any consideration to making an excellent purchase?

Your parents may agree to sell you the property at or below market value, allowing you to save money. This is refer to as a beneficial purchase agreement.

Even if your parents sell the property to you for the amount of the mortgage balance owed, you should be aware that there will be stamp duty and convincing costs related with the transfer of ownership, just as there would be in a traditional sale.

The benefit of making a good deal is that you may avoid the hefty charges associated with working with a real estate agent.

What are the chances of being named as the mortgagee on the mortgage?

It is possible that your attorney may prepare an informal arrangement to have a mortgage in your name registered on the property title;

Consequently, it is vital that you carefully evaluate the decision you are about to make with your parents before proceeding forward. It is possible for familial ties to be sever at any time.

Another option would be to talk about what you would want to do in order to take over responsibility for your parents’ debt with your lender or mortgage broker.

A new home loan application will need to be submit in order for you to become a co-owner of the property. Moreover, stamp duty will be due on any transfers or modifications in the property title that you make in order to include yourself as a party to the transaction.

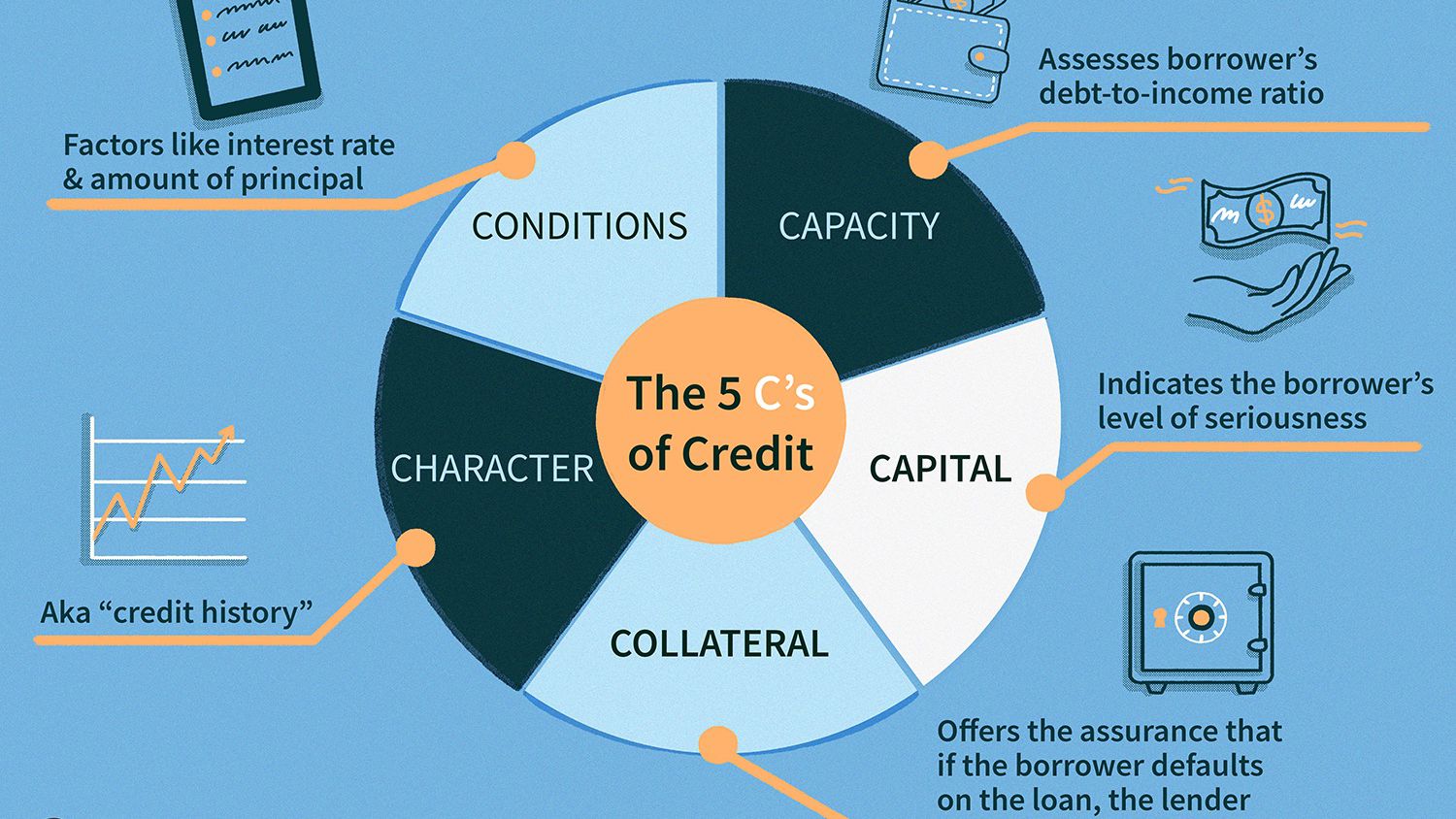

Income, credit history, and overall financial situation, as well as the financial situation of your parents, will considered in determining the serviceability of your loan.